Hello Friends, Welcome to Techmosphere! A blog mainly for students. Today in this article, we will explain some of the most common terminologies used in stock marketing.

I’ll try my best to explain everything as simply as I can. So, let’s talk about the most common stock marketing terminologies.

Stock Marketing Terminologies

1. Bull

This is called to those people who are expecting that the market will go high, their view about the market is Bullish.

2. Bear

It is vice-versa of Bull. This is called to those people who are expecting that the market will fall down, their view about the market is Bearish.

3. Squaring Off

Let suppose if you have bought a stock for 100 INR, and if now you want to sell that stock, in capital market language, it is called that you want to square off that stock.

4. Rally

If a stock is showing movement continuously in either direction up or down, then we can say that the market is showing Rally (in capital market language).

5. Crash

When a particular stock/index/asset shows a sudden fall due to some news/event/result. This is called a Crash/Market Crash.

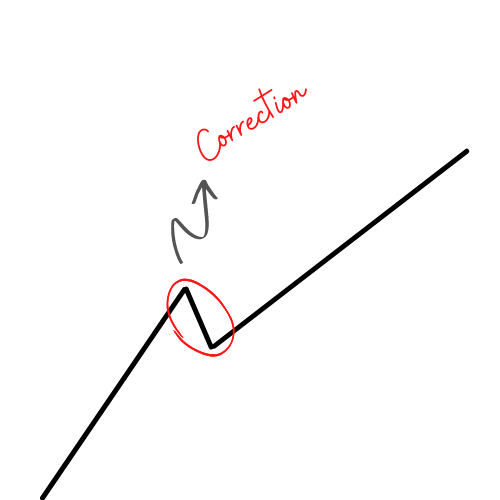

6. Correction

When a stock is going in an up direction but not continuously, it goes up then goes some down, then again goes up; In this phase, the part where the stock was falling down is called a correction. Check out the figure below.

Let suppose if you are a shareholder of ICICI Bank, have bought some shares of ICICI Bank then ICICI Bank will give you some shares completely free of cost as a gift/shareholder gift. This is called Bonus Share.

This is given to those shareholders who keep shares of a particular stock for a long or some particular span of time.

8. Dividend

The dividend is quite similar to Bonus Share. They are of two types:

- Cash Dividend

- Stock Dividend

Let suppose you have bought some share of a company, and you are a shareholder of that company then on the basis of that, the company will give you some cash or some stocks.

If they are giving cash, then it is called a cash dividend and if they are giving some stocks, then it is called a stock dividend.

9. Intraday

When you buy a stock and sell that stock on the same day of buying, then it is called Intraday or Day Trading.

10. Delivery

When you bought some stock today and then you are selling it on any day after today. Then this is called Delivery Trading.

11. IPO (Initial Public Offering)

When a company enters the stock market for the very first time to give its share in the market, then this is called IPO (Initial Public Offering).

12. Brokers

Any company which allows you to trade by providing you a platform for trading, these companies are called Brokers. For example – Zerodha, Upstox, Sharekhan, etc.

13. Portfolio

Simply a portfolio means something like an account of a person where he can see his bought stocks name list, company names, etc.

14. Margin

Let suppose if you want to buy a stock for 1 Lakh INR but you only have 50,000 INR, then the broker can give you the remaining 50,000 INR. This is the amount which is known as Margin.

15. Index

It’s something we can call a group of stocks of different companies which collectively act as a parameter to help us in making our decision for investing. For example – NIFTY, SENSEX, etc.

16. BID Price

It is the price at which we are selling the stock that we bought earlier.

17. ASK Price

It is the price at which we are buying the stock.

18. Bid-Ask Price

The difference between BID price and ASK price is called Bid-Ask Price.

19. Last Traded Price (LTP)

It is the last price at which stock was traded. Let say if a stock was traded at 100.5 INR and then price increased and it was traded at 100.7 INR, then 100.7 INR is the LTP (Last Traded Price).

20. Current Market Price(CMP)

The price which is currently going on in the market.

Great Explanation, Just wow.

Thanks

HI bhaiya

Bro this web is amazing mujhe tho aavi vi yakin nahi ho raha hai ki sach mai mere pass words nahi hai

Impressive and this is helpful for the beginner who has just stepped into the market field.

Good halping for work